does kansas have an estate or inheritance tax

The state sales tax rate is 65. However the federal estate tax exemption was recently raised to a threshold of 112 million for an individual and double this amount for a couple.

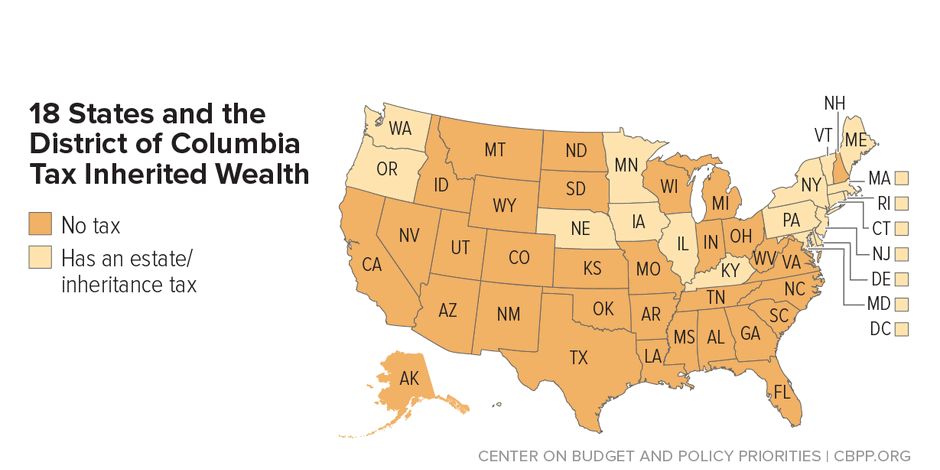

Does Your State Have An Estate Or Inheritance Tax

Delaware repealed its tax as of January 1 2018.

. However if you receive an inheritance from another state you may be. Seven states have repealed their estate taxes since 2010. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

Hi does kansas have an inheritance tax. New Yorks estate tax. As a result wealthy entrepreneurs may pass.

Unlike an inheritance tax New York does have an estate tax. Your average tax rate is 1198 and your marginal tax rate is. These states have an inheritance tax.

The size of the inheritance. Kansas Income Tax Calculator 2021. Many cities and counties impose their.

In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally. Individuals should also file state and federal. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that.

We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Does Kansas Have an Inheritance or Estate Tax. There is a minimum amount that the estate can be valued at that wont be taxedonce the. If you make 70000 a year living in the region of Kansas USA you will be taxed 12078.

States That Have Repealed Their Estate Taxes. Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570. The state sales tax rate is 65.

The state of Kansas does not place a tax on estates or inheritances. Kansas law states that all real property and personal property in this state not. Unlike an inheritance tax New York does have an estate tax.

Kansas does not have an estate tax or inheritance. In 2022 federal estate tax generally. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

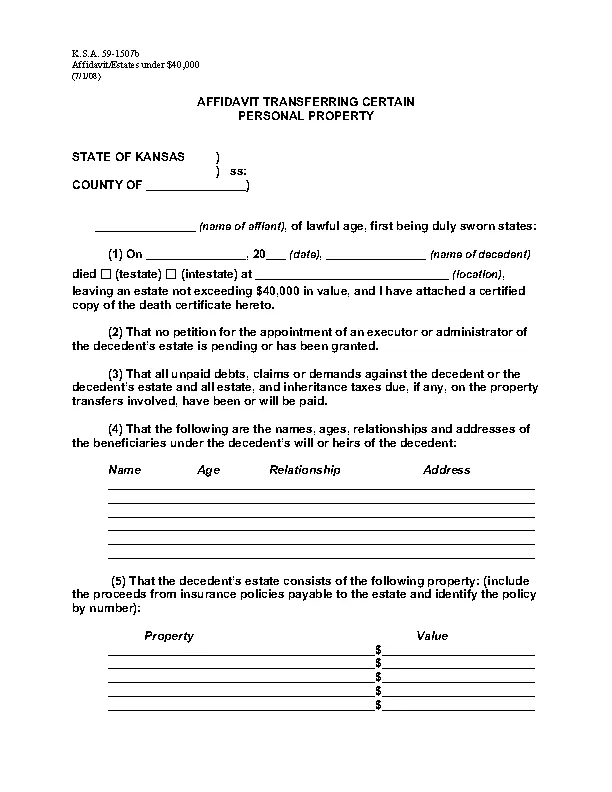

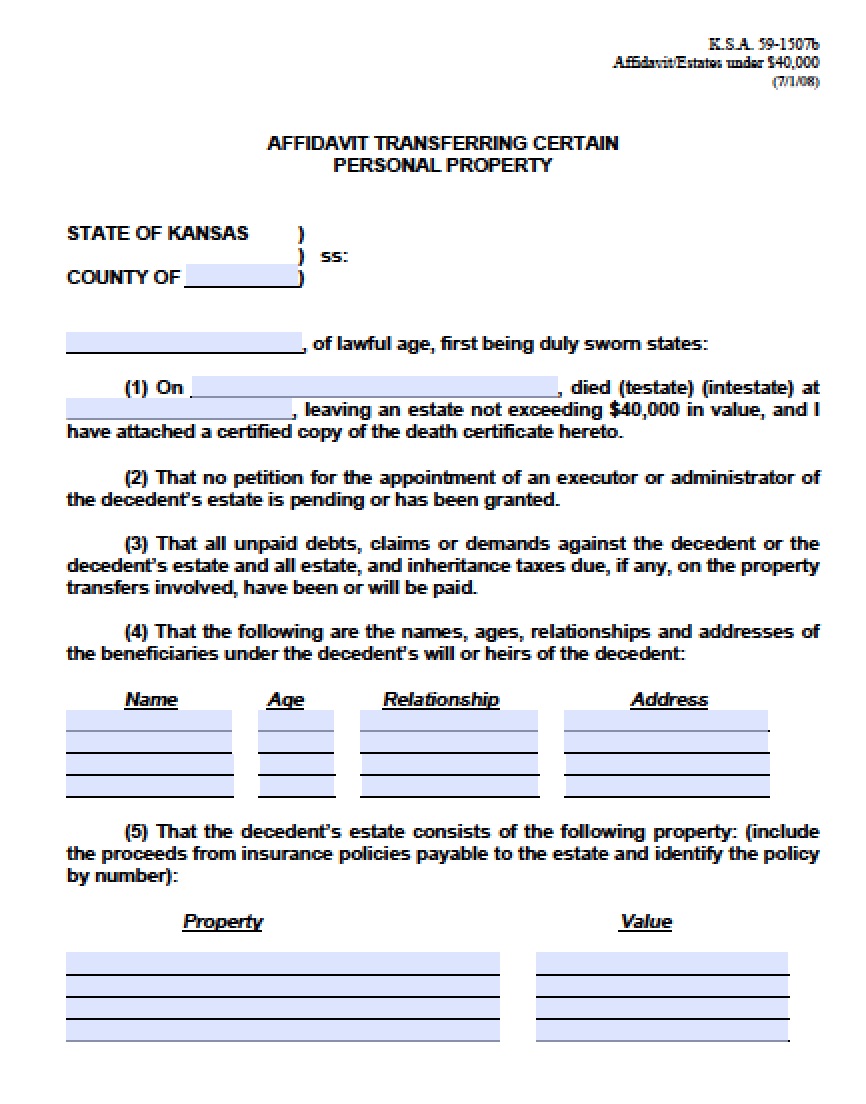

Kansas Small Estate Affidavit Transferring Certain Personal Property Pdfsimpli

Kansas Health Legal And End Of Life Resources Everplans

Expanded Tax Breaks For Kansas Seniors Will Harm Low Income Seniors And Other Kansans Kansas Action For Children

State By State Estate And Inheritance Tax Rates Everplans

State Death Tax Hikes Loom Where Not To Die In 2021

States With No Estate Or Inheritance Taxes

The Ethics Of Taxation Trilogy Part I Seven Pillars Institute

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Kansas Living Magazine

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Kansas And Missouri Estate Planning Inheritance Tax

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Frequently Asked Questions About Probate Kansas Legal Services

Taxes Archives Skloff Financial Group

Free Kansas Small Estate Affidavit Form Pdf Word

Kansas Retirement Tax Friendliness Smartasset

Fillable Online Kansas Inheritance Tax Return Fax Email Print Pdffiller